We can do better than contributing to the right accounts for retirement. Contributing to the right accounts at the right time for your own circumstances is the most powerful strategy to maximize growth and tax benefits.

Question the advice

No offense to those who advise me to max out my 401(k) contribution for retirement, but it really is not a good financial strategy for me. Nonetheless, they are not to blame. Schools don’t educate us about taxes and various tax advantaged accounts. Most of us come unprepared to our first jobs and excited to spend hard-earned money. Some think it’s premature to save or have a long term financial plan. And worst of all, the learnings and improved strategies for tax rules and accounts aren’t well passed down generations or easily digestible online.

If we blindly accept tips without evaluating whether they the right moves for us, by the time we finally figure it out, we already missed the window to achieve full financial potential.

The overlooked no-brainers

There are more strategies than you can count for each individual situation, but there are a couple no-brainers for success—Health Savings Accounts (HSAs) and Roth IRAs. And the power of these accounts are underestimated.

How to use HSAs, Roth IRAs and other accounts together to maximize the return on your contributions? The earlier we learn or educate our kids about these, the better we set ourselves and next generations up for success.

Smart HSA hacks

Most people underuse HSAs, or gradually learn about how to use an HSA over the years as needed. HSAs actually offer the most powerful tax break and can be used as a retirement account. The earlier we master the use of HSAs, the better we boost our financial wellness and lessen the burden of healthcare expenses.

Triple tax saving advantages we all know

- Contribution are pre-tax dollars and income tax deductible

- Investment earnings or capital gains are tax-free

- Qualified withdrawal or expenses are tax-free

There are more eligible tax-free expenses than you think

- Qualified medical expenses

- Long-term care insurance premiums (subject to limits) and qualified long-term care services or facilities

- Health care continuation coverage (such as coverage under COBRA)

- Health care coverage while receiving unemployment compensation under federal or state law

- Medicare premiums and other health care coverage if you were 65 or older (other than premiums for a Medicare supplemental policy, such as Medigap)

It is also worthwhile to browse or look up a comprehensive list of qualified medical expenses. There is likely more than you know and updates.

Start contributing to HSA at 18

There are so many HSA eligible expenses. How do you have enough funds to spend?

An individual can open and contribute to an HSA as early as 18 years old under a qualified high-deductible health plan (HDHP). When else is better timing to enroll in a HDHP than when you are young and healthy? One does not need a job to open an HSA.

For some young adults, a family HDHP makes more sense than an individual HDHP. If not, the earlier the young adult has an independent HSA, the earlier the tax free investment earnings start to compound for life. HSA is the account best to max out the contribution when we are early in our careers not 401(k).

HSA contributions from parents are better tax-advantaged than trust funds

The parent can offer to help contribute to the child’s HSA and/or the child’s medical expenses. When the child has an independent HSA, a family member can still make tax deductible contributions to that HSA. HSAs are the most accessible tool for everyone to protect their wealth and provide for their children, more accessible and better tax-advantaged than trust funds. In the early years of the career, if a young adult can only set aside so much and has to choose between HSA and Roth IRA contribution, it’s worth considering self-contribution to Roth IRA and parents’ contribution to HSA however the payback arrangement is. Contribution starting early is key. And this could be one of the best gifts parents can give to children.

Can HSA replace the need for Long-Term Care?

To be fair, not everyone ends up using long-term care (LTC), and no one knows for sure whether you’ll need it. The return on investment (ROI) of long-term care insurance isn’t great and it doesn’t cover all LTC expenses, but we know for sure that if you don’t use LTC, the premiums you pay go to waste.

Using the HSA to pay for long-term care facilities or services is a good pay-as-you-go option should you need LTC. After decades of contributions and investment returns, your HSA funds will likely cover a handsome sum.

If you choose to use your HSA to pay for LTC insurance premiums, the qualified limits are based on age and are adjusted annually. See updated limit on long-term care premiums you can deduct in the Instructions for Schedule A (Form 1040).

| Attained Age Before End of Taxable Year | 2022 / 2021 Limit |

| 40 or less | $450 |

| More than 40 to 50 | $850 |

| More than 50 to 60 | $1,690 |

| More than 60 to 70 | $4,510 |

| More than 70 | $5,640 |

HSA becomes a 401(k)

At age 65, you can withdraw non-qualified expenses without a penalty. The distributions then are simply taxed as ordinary income, just like a 401(k).

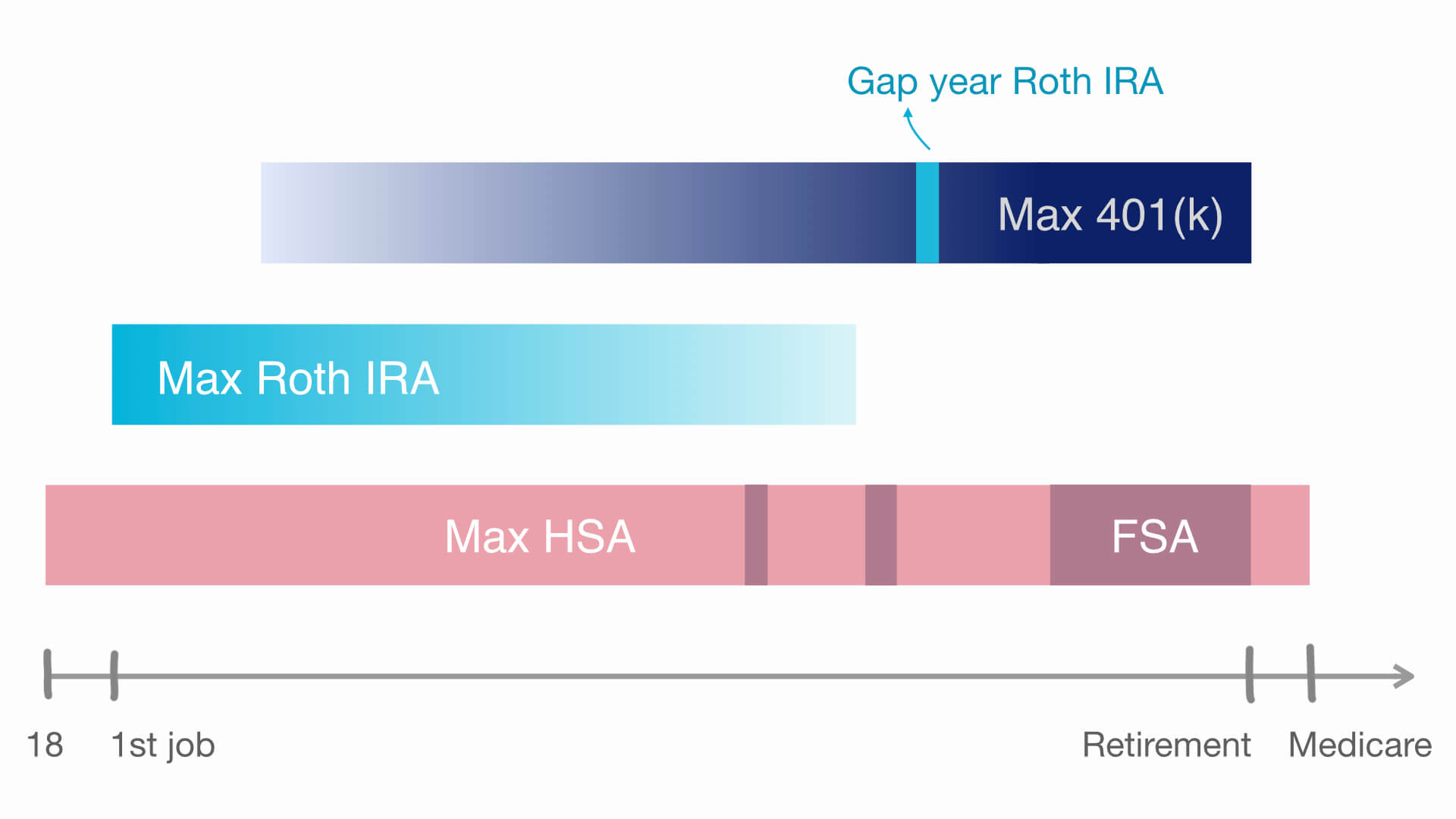

The FSA trick to keep growing HSA as much as possible

Unlike FSA, all contributions to the HSA are yours to keep. Therefore HSA is best used for small or unforeseen healthcare expenses so you can keep and grow your accumulated tax free wealth as much as possible. If there are planned large enough expenses for a particular year, enroll in a low-deductible health insurance plan and contribute the planned amount to a FSA and use FSA fully that year. Use HSA for the rest of the expenses after the FSA balance is used up. Grow your HSA as much as possible because once you enroll in Medicare, you’re no longer eligible to contribute funds to an HSA.

Another way to avoid large expenses from your HSA is to use deduction on Schedule A (Form 1040) if expenses exceed the annual eligibility limit, for example 7.5% of adjusted gross income in 2021.

Manage and Rollover HSA

Although your employer may use a particular HSA provider, you can open you own HSA with your preferred provider and rollover as you see fit. Note that if through an employer, some providers start to charge maintenance fees when you depart from your employer. If you prefer to manage investments in a single HSA account, you can always compare HSA providers before choosing what’s best for you.

HSA inheritance can be tax free too

We would most likely use up everything in the HSA at the end stage. It not, HSA inheritance is completely tax free if spouse is the designated beneficiary. Otherwise, “the amount taxable to a beneficiary other than the estate is reduced by any qualified medical expenses for the decedent that are paid by the beneficiary within 1 year after the date of death.”

Roth IRA

Contribute early too

The benefits of Roth IRA are well known. The contributions are after-tax dollars but your money grows tax-free. This is perfect for the early stage of your career for these reasons:

- Your Modified Adjusted Gross Income is likely eligible

- Your tax bracket is likely lower now than after age 59 ½ if you are still working then. In this case, it’s is better to be taxed early than deferred.

- The first few years of contributions can easily turn into more than 10 times after decades of growth. In this case, it’s is better to be taxed early than deferred after growth.

Don’t forget gap year contribution

If you make more than the Modified Adjusted Gross Income limit, and you take a sabbatical or unpaid leave during employment, a gap year between employment, or are unemployed for a few months, and your Modified Adjusted Gross Income of that year becomes under the Roth IRA limit, you can max out your Roth IRA contribution that year. You also have the option to convert the Roth IRA contribution limit amount from your 401(k) to your Roth IRA that year. Either way, you pay income taxes on the contributions.

How to position HSA, Roth IRA and 401(k)?

How to best utilize HSA, Roth IRA and other accounts through the lifecycle to help maximize tax advantages and your financial wellness? It depends on your income level trajectory and your own situation, but generally:

Contribution

- When you are young or earn less: Max out your HSA and Roth IRA not 401(k)

- When you earn a lot: Max out your HSA and 401(k)

Growth

- Spend little from HSA

- Spend large with FSA or Schedule A

- Invest wisely everywhere